5 Cozy Rituals to End the Year Grounded, Grateful, and Debt-Free

Ease Into Abundance

As the year winds down, give yourself permission to slow your pace and trust your progress. Abundance meets you when you move with intention, gratitude, and grounded peace — not pressure…

Hello, lovely soul! As the days grow shorter and a crispness fills the air, there's a natural inclination to reflect, to slow down, and to prepare for the festive season ahead. For many of us, especially those juggling the demands of working from home, entrepreneurship, or demanding professional careers, this time of year can feel less like a cozy transition and more like a whirlwind of to-dos, expectations, and financial pressures. If you’re feeling overwhelmed and yearning for a wellness and financial reset, you've landed in the right place. The Honey Chestnut is here to guide you through five comforting rituals designed to help you end the year grounded, grateful, and yes, even debt-free.

This isn't about rigid rules or sacrificing joy. It's about cultivating a money mindset that supports your well-being, about smart budgeting, and about truly embracing the spirit of the holidays without the looming shadow of financial stress. We’ll explore how small, intentional shifts can lead to profound impacts, creating a sense of calm and control as you navigate the busiest time of the year. So, grab your favorite warm drink, settle into a comfy spot, and let’s embark on this journey together.

Ritual 1: The Gratitude & Abundance Journal – Shifting Your Money Mindset

Our first cozy ritual invites you to embrace the power of gratitude, not just for the big blessings, but for the quiet everyday moments that often go unnoticed. This is more than just jotting down thanks; it’s a profound exercise in shifting your money mindset from scarcity to abundance. When we focus on what we have, rather than what we lack, we open ourselves up to receiving more, both financially and emotionally.

To begin, find a beautiful notebook that inspires you – something that feels special and personal. This will be your gratitude and abundance journal. Each evening, or whenever you have a quiet moment, dedicate a few minutes to writing down at least three things you are genuinely grateful for from your day. These don't have to be grand gestures; perhaps it's the warmth of your coffee, a productive meeting, a child’s laughter, or a moment of unexpected peace.

Now, here’s where the abundance part comes in. Alongside your general gratitude, make a conscious effort to acknowledge any instances of financial abundance, however small. Did you find a forgotten five-dollar bill in your coat pocket? Did you receive a discount you weren’t expecting? Did a client pay promptly? Did you make a sale? Even seemingly minor financial wins contribute to a feeling of prosperity. By recognizing these, you’re training your brain to see opportunities and to appreciate the flow of money in your life. This practice gently rewires your perspective, helping you to feel more secure and less anxious about your financial situation, which is a crucial first step in any financial reset. This ritual reminds us that gratitude is not just a feeling, but a powerful catalyst for positive change in our money journey.

Reset Your Energy, Realign Your Finances

Before the year ends, take time to pause. Reflect on your wins, release the worry, and reset your financial goals with grace. Peaceful money habits begin with calm energy and clear intention.

Ritual 2: The Mindful Budgeting Brew – Crafting a Realistic Financial Reset

The second ritual is all about a mindful approach to your finances, transforming the often-dreaded task of budgeting into a calming and empowering experience. Let's call it the Mindful Budgeting Brew. This ritual is particularly potent for those seeking a financial reset as the year draws to a close, especially with holiday planning on the horizon. The goal isn't just to track spending, but to gain clarity, make intentional choices, and align your financial actions with your values.

Set aside a dedicated time each week for your Mindful Budgeting Brew. Choose a quiet moment when you can truly focus, perhaps with a calming herbal tea or your favorite comforting beverage. Gather all your financial information: bank statements, credit card bills, and any income sources. Instead of approaching this with dread, view it as an opportunity to nurture your financial well-being.

As you review your transactions, categorize them mindfully. Are there areas where you’re consistently overspending? Where can you gently trim without feeling deprived? This isn't about judgment; it’s about observation and conscious decision-making. Think about your upcoming holiday expenses. Can you create a dedicated holiday budget that feels manageable and stress-free? This might involve setting aside a small amount each week or identifying specific areas where you can reduce spending to allocate more to gifts and celebrations. Remember, a realistic budget is a living document, not a rigid constraint. It’s a tool to empower you, allowing you to allocate your resources in a way that brings you peace of mind and enables you to move towards a debt-free end to the year. This gentle, consistent engagement with your finances is the cornerstone of a sustainable financial reset, building confidence in your ability to manage your money effectively.

Gratitude Is Your Greatest Investment

Every lesson, every paycheck, every moment of growth — be thankful. Gratitude multiplies what you already have and shifts your mindset from lack to abundance. A grateful heart always attracts more peace and prosperity.

Ritual 3: The Gift of Thoughtfulness – Intentional Holiday Planning

As the festive season approaches, our third ritual encourages you to embrace the Gift of Thoughtfulness, moving away from consumeristic pressures and towards intentional holiday planning. For many working from home parents, entrepreneurs, and busy professionals, the holidays can become a source of immense financial strain and stress. This ritual aims to reframe your approach, making the season more meaningful and less about accumulating debt.

Before you even think about shopping, take some time to reflect on what truly matters to you and your loved ones during the holidays. Is it the elaborate gifts, or is it shared experiences, quality time, and heartfelt gestures? Once you’ve identified your core values for the season, let these guide your decisions.

Consider thoughtful, personalized gifts that don't necessarily break the bank. This could mean homemade treats, a coupon book for services (like a home-cooked meal or help with a project), or a carefully chosen book. Perhaps a group experience is more fitting than individual presents – a family outing to a local attraction or a shared meal at a favorite restaurant. For those with children, involve them in the process of creating handmade gifts or planning a special family activity. This not only saves money but also fosters creativity and deeper connections. By intentionally planning your holiday spending and focusing on the sentiment behind your gifts, you can avoid the trap of impulse purchases and the accompanying financial anxiety. This proactive approach to holiday planning is a powerful component of your financial reset, ensuring that you can enjoy the season debt-free and truly grounded in gratitude.

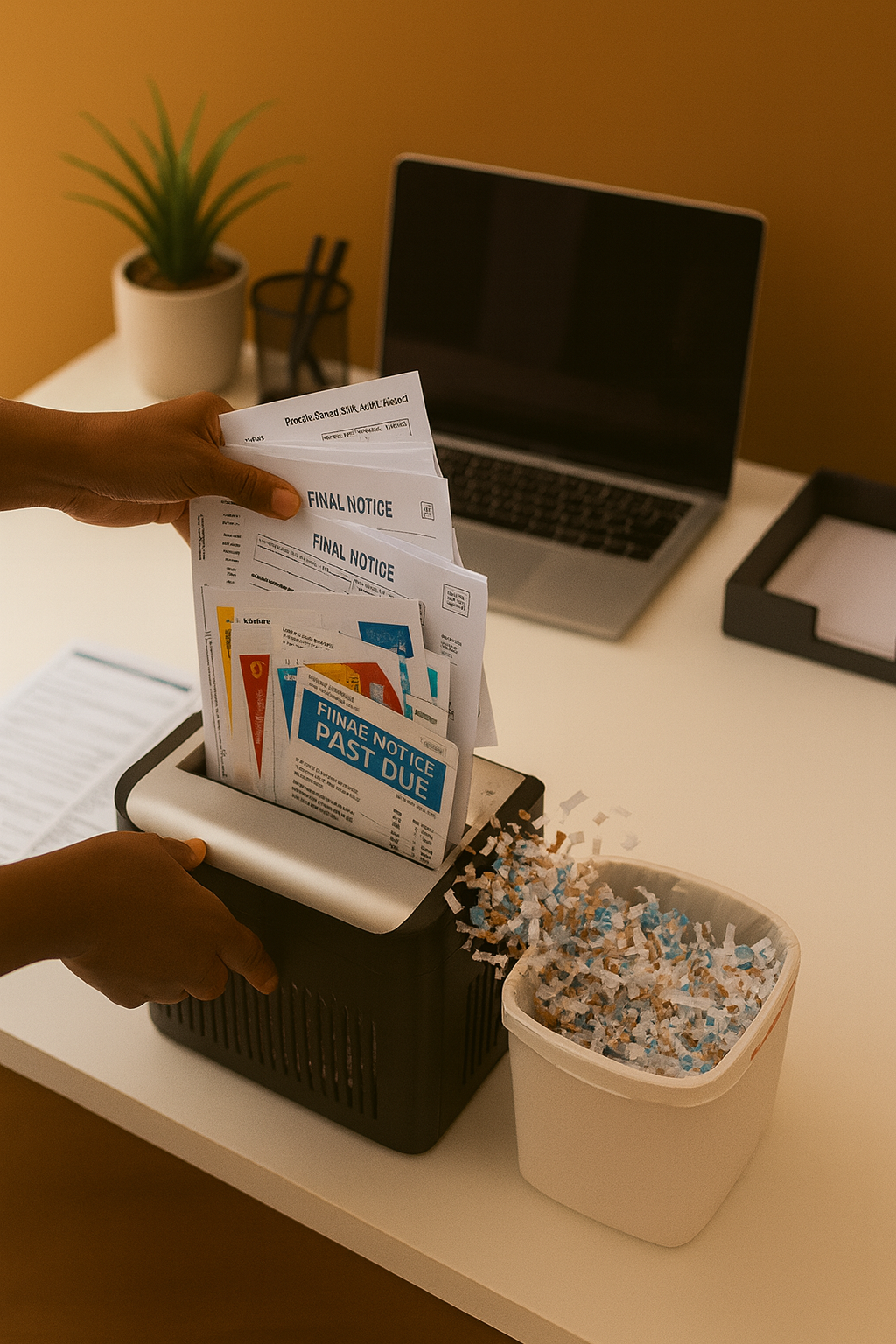

Ritual 4: The Debt-Free Detox – Clearing Financial Clutter

The fourth cozy ritual invites you into a Debt-Free Detox, a powerful practice for clearing financial clutter and setting yourself on a path to a debt-free year-end. For many, the idea of tackling debt feels daunting, but by approaching it with intention and a clear money mindset, it transforms into an empowering act of self-care. This detox is especially crucial for busy individuals who might find debt accumulating almost unnoticed amidst their demanding schedules.

Begin by gathering all your debt statements: credit cards, personal loans, and any other outstanding balances. Instead of feeling overwhelmed, view this as an inventory, a snapshot of where you currently stand. Create a simple visual representation of your debts – perhaps a list, or even a small drawing that symbolizes each one. Seeing it all in one place can be incredibly clarifying.

Now, consider a strategy for tackling these debts. This isn’t about instant gratification, but about consistent, manageable steps. Can you identify one small debt to focus on paying off completely by the end of the year? Even a small victory can provide immense momentum and a boost to your money mindset. Look for areas in your budget (from Ritual 2) where you can reallocate funds to accelerate debt repayment. Perhaps it's a subscription you no longer use, or a few less takeout meals each week. If you have multiple credit cards, consider consolidating them to simplify payments and potentially reduce interest. This detox is about intentionally reducing your financial burdens, allowing you to breathe easier and feel more in control. By actively engaging in this Debt-Free Detox, you’re not just paying off loans; you’re investing in your peace of mind and setting a strong foundation for a truly fresh start.

Release to Receive

Let go of what no longer serves your spirit or your wallet. Whether it’s lingering debt, emotional clutter, or comparison energy — clearing the old creates room for new blessings to flow in.

Ritual 5: The Future Fund Flourish – Cultivating Sustainable Wealth

Our final cozy ritual, The Future Fund Flourish, shifts our focus from immediate relief to cultivating sustainable wealth and a thriving financial future. After working through gratitude, mindful budgeting, intentional holiday planning, and a debt-free detox, this ritual helps solidify your financial reset and encourages long-term growth. This is about nurturing your financial garden so it can flourish for years to come, providing a secure and grounded feeling for working from home parents, entrepreneurs, and professionals alike.

The Future Fund Flourish involves dedicating a small, consistent portion of your resources to building your savings and investments. It’s not about grand gestures or large sums initially, but about establishing a consistent habit that will compound over time. Think of it as planting seeds for your future self.

Start by setting up an automated transfer, even if it’s a modest amount, from your checking account to a dedicated savings account or investment vehicle each pay period. The beauty of automation is that it removes the need for conscious decision-making, making saving a seamless part of your financial routine. Consider what your future self might need: an emergency fund, a retirement nest egg, or perhaps a down payment for a dream home. Even small contributions, consistently made, can grow significantly over time thanks to the power of compounding. This ritual reinforces a positive money mindset, moving you from merely managing your finances to actively growing them. By nurturing your Future Fund Flourish, you’re not just preparing for tomorrow; you’re creating a sense of security and freedom that will allow you to live more fully in the present, grounded in the knowledge that your financial well-being is taken care of.

Rest Like It’s Revenue

Stillness is wealth in motion. Rest isn’t a luxury — it’s a ritual. When you restore your body and quiet your mind, you make space for better decisions, stronger focus, and aligned abundance.

Embracing Your Grounded, Grateful, and Debt-Free Journey

As we gently close the book on these five cozy rituals, we hope you feel a renewed sense of purpose and calm as you approach the end of the year. This journey from an overwhelmed mindset to one that is grounded, grateful, and debt-free is not a sprint, but a series of intentional, loving steps. Each ritual, from cultivating a money mindset through gratitude to crafting a mindful budget and embracing a debt-free detox, builds upon the last, creating a holistic approach to your financial and emotional well-being.

Remember, the goal is not perfection, but progress. Life’s demands will always be there, but with these practices, you now have a toolkit to navigate them with greater ease and confidence. You’ve learned to appreciate the abundance around you, to make conscious financial choices, to celebrate the holidays with intention, to clear away financial burdens, and to plant the seeds for a flourishing future. This is your personal financial reset, a testament to your commitment to a more peaceful and prosperous life.

If you’re ready to dive even deeper, to truly transform your relationship with money, and to connect with a community of like-minded individuals on a similar path, we invite you to explore The Credit & Calm Collective. This exclusive program offers comprehensive resources, personalized guidance, and unwavering support to help you achieve lasting financial peace and unlock your full potential. Join us and continue your journey towards a life of financial freedom and unwavering well-being.

Visit thehoneychestnut.com for more resources.

Wishing you a truly grounded, grateful, and debt-free end to the year, and a beautiful start to all that lies ahead. From our hearts at The Honey Chestnut to yours, thank you for being here.