The Connection Between Financial Wellness and Inner Peace

Have you ever noticed how hard it is to relax when your bills are piling up or your credit score is weighing on your mind? You can light all the candles, take all the bubble baths, and repeat affirmations daily — but if your finances are in chaos, true peace can feel just out of reach.

Here’s the truth: financial wellness and inner peace go hand in hand. When your money is in order, your mind and spirit have the space to breathe, dream, and thrive. This article will explore why your finances and your well-being are deeply connected — and how you can start aligning them today.

Why Money Stress Affects the Mind

Uncertainty breeds anxiety. Not knowing how you’ll cover next month’s expenses is a major cause of sleepless nights.

Debt creates emotional weight. Carrying credit card balances or unpaid bills can leave you feeling trapped.

Financial insecurity impacts relationships. Studies show that money is the leading cause of stress in relationships.

Money is more than numbers — it’s tied to safety, stability, and self-worth. That’s why getting your finances on track isn’t just a “practical” move, it’s a wellness practice.

What Is Financial Wellness?

Think of financial wellness as the money version of self-care. It doesn’t mean being rich — it means having a system that keeps you secure, prepared, and aligned with your goals.

Financial wellness looks like:

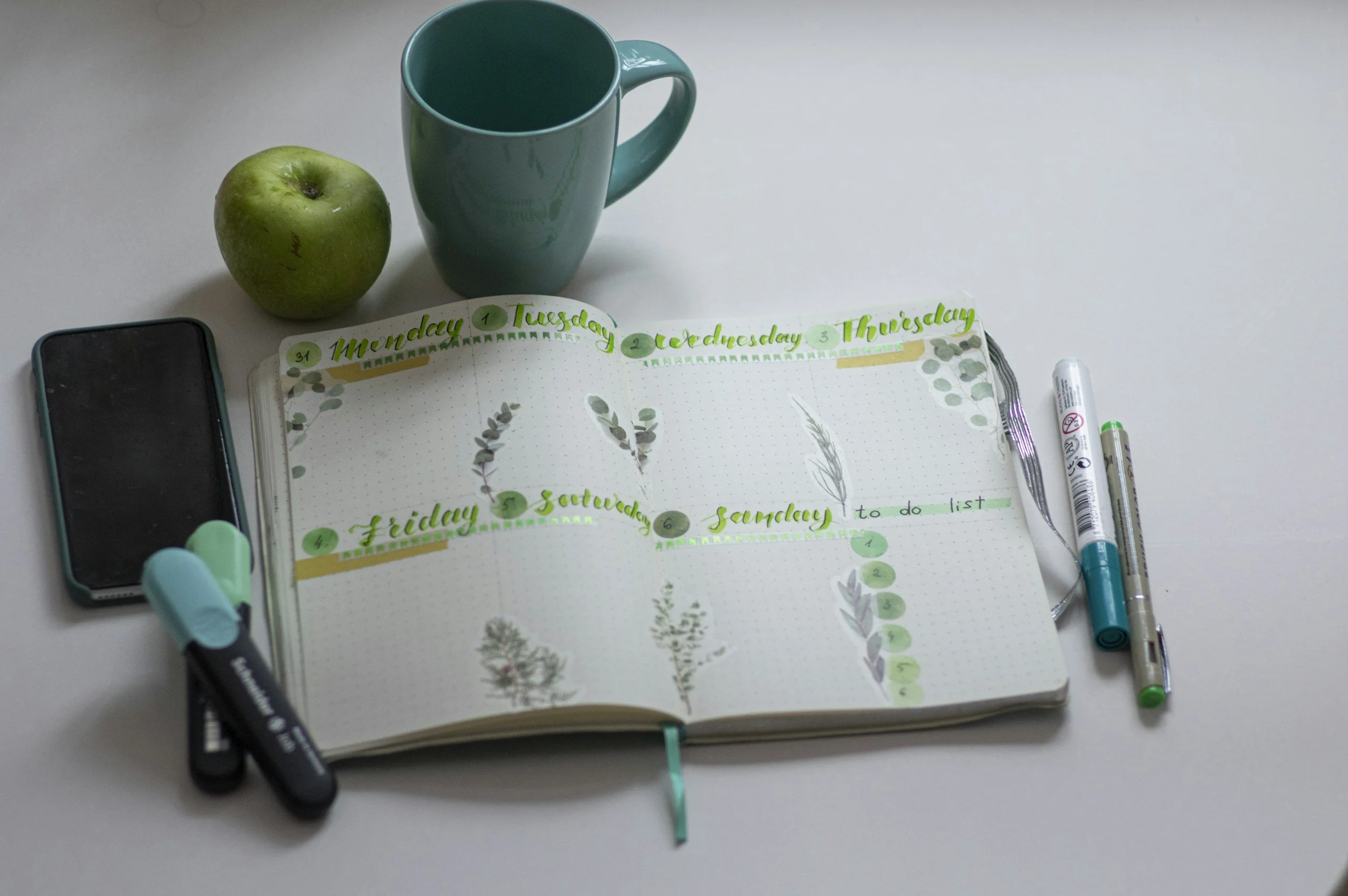

A working budget that reflects your real life (not an impossible plan).

An emergency fund to cushion unexpected events.

A healthy credit score that gives you options.

Spending that matches your values — not just impulse purchases.

The Spiritual Connection

When your finances are steady, you’re not living in fear — you’re living in flow. Inner peace comes from clarity and control, both of which financial wellness brings.

Budgeting = mindfulness (awareness of where your money flows).

Saving = self-respect (prioritizing your future self).

Paying off debt = release (shedding old burdens to move forward).

By treating your money as an extension of your well-being, you’re honoring yourself and creating a life that feels grounded.

Practical Steps to Align Your Finances & Peace

Start with Mindset. Replace “I’ll never get ahead” with “I’m learning how to build stability.”

Track, Don’t Judge. Write down your expenses without guilt. Awareness is the first step to change.

Create a Peace Budget. Add a line item for “joy” (a weekly coffee, a new book, or a small trip). Peace doesn’t come from deprivation — it comes from balance.

Repair Your Credit. A stronger score means less stress when it’s time to rent, buy, or borrow.

Set Mini-Goals. $500 saved, one credit card paid off, a month of tracked expenses. Celebrate small wins.

Real-Life Example

One of my clients came to me overwhelmed — bills stacked high, credit score at 530, and no savings. Together, we created a budget, disputed errors on her credit, and started small savings habits. Within six months, her score climbed above 650, and she told me: “For the first time in years, I’m not waking up in panic.”

That’s the power of aligning financial health with peace of mind.

Final Thoughts

Peace doesn’t just come from meditation pillows or spa days. It comes from knowing your home, your finances, and your future are secure. By treating your finances as a form of self-care, you’re not just improving your bank account — you’re protecting your spirit.

Remember: Financial wellness is self-love in action.

Ready to take the first step toward financial wellness and peace? Download my free Budget + Calm Guide begin your journey today.