How to Save $10,000 Fast: The Ultimate Guide for Entrepreneurs, Homebuyers, and First-Time Investors

Introduction

Welcome! If you're here, chances are you're ready to level up your finances and make a big move—maybe buy your first (or second) home, launch an investment property, pay off some debt, or finally build that safety cushion for your business. Saving $10,000 might sound like a steep climb, but with the right strategy and mindset, you can absolutely crush it—and faster than you think.

This guide is packed with real-life, action-ready advice tailored for entrepreneurs, beginner investors, and first-time homebuyers. We’ll walk you step-by-step through smart saving habits, the power of compound interest, high-yield savings accounts, and multiple money-stacking strategies.

Let’s break this down together.

Feeling accomplished after depositing into your high-yield savings account.

Chapter 1: Setting a Bold but Realistic Goal

Before we talk dollars, let’s talk intention. Setting a specific, measurable goal gives your savings plan power. You’re not “just saving”—you’re saving for your future home, your first rental property, or your financial peace of mind.

💡 Why $10,000?

It could be your full down payment for a low-cost FHA home.

It might cover the startup costs of your dream small business.

It could be your ticket to closing on your first investment deal.

Write this down in your notes or planner:

"I’m saving $10,000 in 6 months to build a safety cushion."

Chapter 2: Start With What You Have

💰 The Power of a Starting Balance

Let’s say you start with $2,500 in a high-yield savings account. That’s your seed money.

💥 Pro Tip:

Use a compound savings account to start generating interest immediately.

Top Options:

Set up auto-transfers. Even saving 50 cents per day turns into $15/month—and $180+ annually. When compounded, it grows exponentially over time.

Line graph of compound interest earnings over one year.

Chapter 3: Free Tools to Track & Stack Your Cash

📲 Apps to Help You Save & EarnRocket Money: Cancels unused subscriptions and negotiates bills.

You Need a Budget (YNAB): Detailed budgeting software (free 34-day trial).

Fetch Rewards: Earn points and cash back from scanning grocery receipts.

Rakuten: Get up to 10% cash back for everyday shopping.

Acorns: Invest spare change from your purchases.

Use these together to create a financial ecosystem that works for you.

Top free personal finance apps for saving money.

Chapter 4: Slash, Sell, & Stack (a.k.a. Find $1,000–$3,000 Right Now)

✂️ Slash ExpensesStart with your last 3 bank statements. Highlight anything recurring that doesn’t serve your goal:

Unused gym memberships

Streaming services you rarely use

Food delivery and late-night Amazon buys

Cancel, pause, or swap.

💸 Sell Stuff

Take inventory:

Designer bags you don’t wear?

Tech that’s gathering dust?

Unused fitness gear?

List on:

Facebook Marketplace

eBay

OfferUp

Poshmark (for fashion)

A good purge = instant savings.

📦 Example:

One reader sold a few Apple devices and an old couch = $2,200 in 10 days.

If your closet looks similar to this…you could be sitting on a gold mine!

Chapter 5: Multiply Your Income Without Burning Out

🚗 Part-Time Hustles

Uber, Lyft, DoorDash: Make $20–$30/hr

Rover or Wag: Dog walking/sitting for $50–$300/weekend

Amazon Flex: Deliver packages on your schedule

💼 Freelance Fast

Are you good at:

Writing

Graphic Design

Admin support

Voiceovers

Set up a profile on:

Fiverr

Upwork

Toptal (higher end)

Example: Writing 5 blog posts/month at $200 each = $1,000+ extra income.

Side hustle income from freelance business at home or anywhere!

Chapter 6: Compound Savings For Real Estate Goals

You’re not just saving—you’re investing in your future.

🏠 For HomebuyersAim for 5%–20% down depending on loan type

$10K might cover closing costs, inspections, and down payment

Use lender programs like NACA or FHA to qualify with lower down

🏘 For Real Estate InvestorsSave 25% down minimum for rental properties

Use your savings for rehab, inspections, appraisals, and more

🏦 Use Local & Minority-Owned Banks

Resources:

US Bank Minority Programs

OneUnited Bank – Largest Black-owned bank

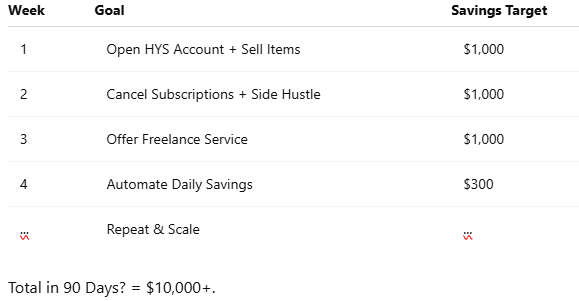

Chapter 7: The 90-Day $10K Blueprint

Break it down by week:

Week Goal Savings Target 1 > Open HYS Account > + Sell Items $1,000

2. Cancel Subscriptions + Side Hustle$1,000

3. Offer Freelance Service$1,000

4. Automate Daily Savings$300...

Repeat & Scale...

Total in 90 Days? = $10,000+.

Chapter 8: Final Tips, Habits & Mindset Hacks

✨ Create a Savings RitualEvery morning or night, check your balance and visualize your goal.

🧠 Mindset = Momentum

Use affirmations: "I am building wealth daily."

Journal your wins weekly

Treat savings like a non-negotiable bill

📚 Tools to Stay Focused

Printable 10K Savings Tracker

Daily Money Affirmations

Budget + Side Hustle Planner PDF

Conclusion: Your Future is Waiting

Saving $10K fast isn’t about luck—it’s about strategy, discipline, and belief. Every dollar you stack is another brick in the foundation of your future.

Let this article be your blueprint. Now go build.

Ready to Start? ✅ Open your high-yield savings account today. Try Varo Bank or Chime.

✅ Download free tools like Rocket Money and Fetch Rewards.

✅ Bookmark this article and share it with someone ready to thrive.

10K Fast Tool Kit

Ready to Save $10K Fast? Here’s the Toolkit That’ll Help You Get There

If you’ve been dreaming of buying your first (or second) home, investing in property, or building a serious financial cushion—this is for you.

I created the Save $10K Fast Toolkit to give you exactly what I wish I had when I started:

A clear, calm, and simple system to stack your savings without stress.

✨ What’s Inside the Toolkit:

✅ A 10K Savings Tracker to visually mark your progress

✅ A Budget + Side Hustle Planner to organize your money + income

✅ Daily Money Affirmations to reset your mindset

✅ A 90-Day Challenge Worksheet to break your goal into real steps

Whether you’re a first-time homebuyer, new investor, or entrepreneur rebuilding your finances, this bundle was made to help you move with purpose.

💌 Want the Toolkit?

⬇️ Drop your name + email below and I’ll send it straight to your inbox:

💭 A Final Note

I created this with love and intention—because I know what it’s like to feel overwhelmed by big goals and uncertain timelines. This toolkit is your gentle nudge back into action.

You’ve got this. Let this be your reset!