Your Pre-Approval Checklist: What Lenders Actually Want

Becoming a homeowner starts long before you step inside your first open house — it starts with pre-approval.

But here’s the truth most people don’t say:

✨ Pre-approval is not about perfection

✨ It’s not about having everything figured out

✨ And it’s not meant to stress you out

Pre-approval is simply a snapshot of your financial picture so a lender can understand what price range you qualify for.

And when you know what to expect, the entire process becomes calmer, easier, and way less overwhelming.

Below is your peaceful, step-by-step guide to every document a lender will ask for — and why.

Why Pre-Approval Matters

Pre-approval helps you:

✔ Know your true budget

✔ Become a serious buyer (agents LOVE this)

✔ Lock in interest-rate expectations

✔ Strengthen your offer in a competitive market

✔ Avoid wasting time on homes outside your range

Looking at homes before getting pre-approved is like going grocery shopping with no wallet.

You don’t know what you can actually bring home.

Pre-approval gives you clarity — and peace.

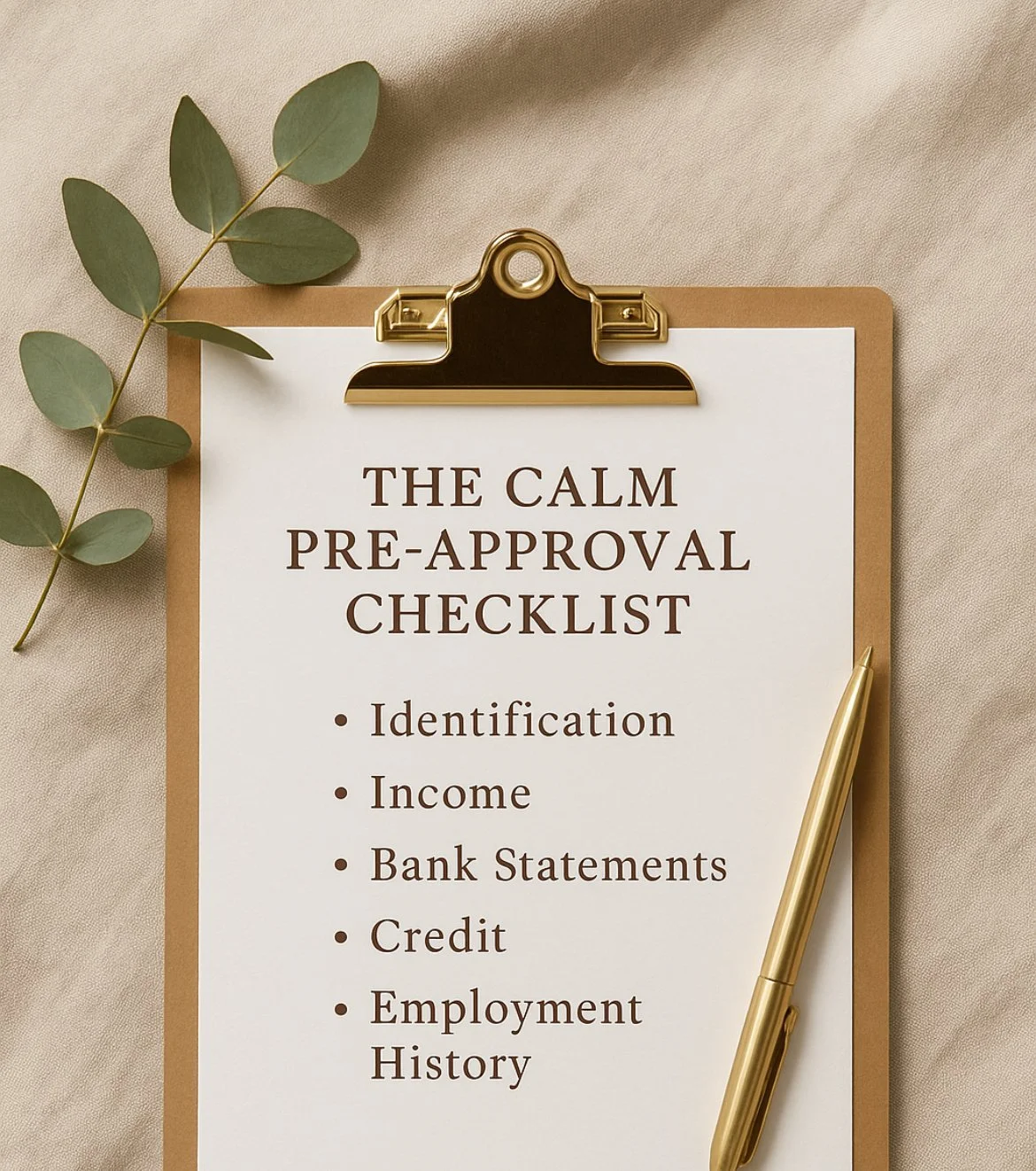

What Lenders Really Want: The Calm Pre-Approval Checklist

Here are the exact documents lenders ask for, why they need them, and how to organize them without stress.

1. Identification

What you’ll need:

Driver’s license OR state ID

Social Security number

Why they need it:

To verify you’re the correct applicant and run your credit.

2. Income Verification

This shows the lender your ability to comfortably make mortgage payments.

Depending on your job type:

If you’re employed (W-2):

2 most recent pay stubs

Last 2 years of W-2s

Employment verification (they handle this)

If you’re self-employed or 1099:

Last 2 years of full tax returns

Year-to-date profit and loss (P&L)

Bank statements showing income consistency

Peace Tip:

Gather these into a labeled folder before you even apply. It reduces stress by half.

3. Bank Statements (Proof of Funds)

Lenders typically need:

Last 2 months of bank statements

Savings accounts

Any large deposits explained

They’re checking:

✔ that your down payment is legit

✔ that your money is seasoned (not borrowed yesterday)

✔ that you have reserves in case of emergencies

4. Credit Profile

This includes:

Your credit score

Your open accounts

Your debt-to-income ratio (DTI)

Peace & Credit™ Insight:

Your credit doesn’t have to be perfect — it just has to be honest.

If your score needs work, let that be information, not shame.

Pre-approval is awareness, not judgment.

5. Employment History

Lenders want:

Stability

Predictability

Proof of consistent income

They typically review your last 2 years of work history.

Gaps don’t disqualify you — they just need explanation.

6. Debt Documentation

If you have:

Auto loans

Student loans

Child support

Personal loans

Your lender will include these in your DTI calculation.

This helps determine a safe monthly payment for your budget.

7. Assets + Down Payment Details

If you have:

Savings

Retirement accounts

Gift funds

Investment accounts

Lenders need documentation to verify your ability to close the loan.

Gift fund tip:

You must have a letter stating it’s a gift, not a loan.

How to Prepare Without Stress: The Peaceful Buyer Routine

Here’s how to stay grounded during pre-approval:

✨ Create a “Homebuyer Folder” in Google Drive

✨ Label each doc: Income, ID, Credit, Taxes, Bank Statements

✨ Upload everything once — reuse it for every lender

✨ Don’t try to gather everything in one day

✨ Keep your spending calm + consistent

✨ Avoid large deposits unless fully documented

This turns a stressful process into a peaceful one.

What Happens After You Submit?

Once your lender reviews your info, you’ll receive:

1️⃣ Your pre-approval amount

2️⃣ Your estimated monthly payment

3️⃣ Your interest rate range

4️⃣ Your next-step checklist

This is the moment everything becomes real.

You’ll know exactly what you can afford — and what to do next.

Common Myths That Stop Buyers (Don’t Let Them)

❌ “I need perfect credit.”

Truth: Many buyers get approved with 580–620 scores.

❌ “I must have 20% down.”

Truth: FHA can be as low as 3.5%, and conventional as low as 3%.

❌ “My debt disqualifies me.”

Truth: Lenders look at ratios, not shame.

❌ “I’m not ready.”

Truth: Pre-approval tells you where you stand so you CAN get ready.

Final Thoughts: Pre-Approval = Clarity, Not Pressure

Your pre-approval is simply information — not a commitment.

You are not locked into a lender.

You are not obligated to buy immediately.

Final Thoughts: Pre-Approval = Clarity, Not Pressure

Your pre-approval is simply information — not a commitment.

You are not locked into a lender.

You are not obligated to buy immediately.

This is a clarity checkpoint, not a contract.

Approach it with calm confidence.

You deserve a peaceful path to homeownership.

This is a clarity checkpoint, not a contract.

Approach it with calm confidence.

You deserve a peaceful path to homeownership.

Ready to Start Your Peaceful Homebuyer Journey?

The Chestnut Vault has a full category dedicated to:

✨ Homebuyer guidance

✨ Credit preparation

✨ Peaceful financial planning

✨ Calm checklists and next steps

👉🏽 Explore the Credit & Homeownership Section

You’re building a life rooted in peace — and your homeownership journey gets to reflect that too.

Download the Ultimate Pre-Approval Checklist now to walk into your mortgage meeting prepared, confident, and ready to fast-track your homeownership journey.